There’s a quiet but powerful movement happening in real estate investing—one that rarely makes the headlines. Across the country, banks and hedge funds are selling off pools of distressed mortgage notes, often at deep discounts. For investors with the right setup, particularly those using a self-directed IRA, this presents a chance to grow wealth in a tax-advantaged way while helping restore struggling properties to productive use.

Understanding the Opportunity in Mortgage Notes

A mortgage note is simply the loan that secures a piece of real estate. When borrowers stop making payments, the note becomes “non-performing.” Banks and government agencies like Fannie Mae and Freddie Mac routinely sell these non-performing assets—sometimes by the billions—to hedge funds and other institutional buyers. Those funds then break the large pools into smaller groups that are sold to individual investors.

The appeal is straightforward: investors buy the debt, not the property, and control the outcome. You can work with borrowers to get the loan paying again, take possession of the property through foreclosure, or sell it for profit. Notes often trade for a fraction of the property’s value—sometimes pennies on the dollar—leaving room for significant returns.

Setting Up a Self-Directed IRA

To take part in these opportunities with retirement funds, you’ll need a self-directed IRA (SDIRA). Unlike traditional IRAs held by brokerage firms that limit you to stocks, bonds, and mutual funds, a self-directed IRA allows you to invest in alternative assets such as real estate, mortgage notes, private loans, and more.

Setting one up involves choosing a custodian that specializes in self-directed accounts. After rolling over funds from an existing IRA or 401(k), your custodian will hold the assets and execute transactions on your direction. You decide what to buy; they handle the paperwork and compliance to keep your account in good standing with the IRS.

Once your SDIRA is funded, you can purchase mortgage notes directly under the IRA’s name. All profits, payments, and expenses flow through the account—never through your personal bank account—maintaining the tax-advantaged status of your retirement funds.

The Tax Advantages of Using a Roth IRA

If your self-directed account is structured as a Roth IRA, the potential benefits multiply. With a Roth, you contribute after-tax dollars—meaning you don’t get a tax deduction upfront—but your investments grow tax-free. More importantly, qualified withdrawals in retirement are also tax-free.

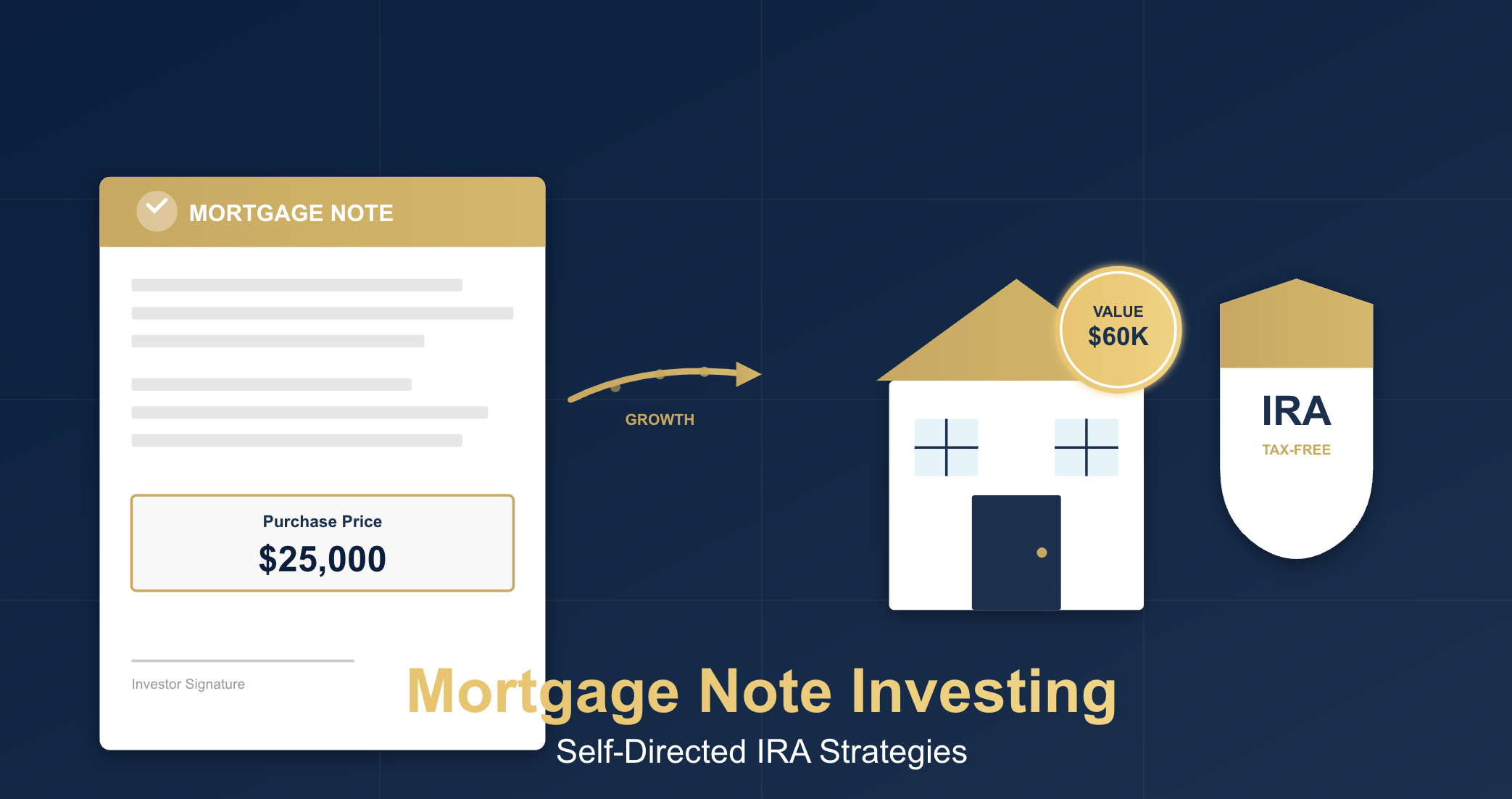

That means if your Roth IRA buys a non-performing note for $25,000, works it out with the borrower, and later sells it for $60,000, every dollar of profit stays in your IRA—without a tax bill. Over time, that compounding tax-free growth can dramatically accelerate wealth building.

Holding real estate or notes in a Roth also protects you from capital gains and ordinary income taxes that would otherwise apply if you made those same deals personally. It’s one of the most efficient vehicles for long-term, high-yield real estate investing.

How the Investment Works in Practice

Let’s look at what happens after you buy a note. Each loan represents a unique situation, but generally, you’ll take one of several paths to create value:

-

Reperforming the loan: Work out a new payment plan with the borrower to get them back on track. This can turn a non-performing note into a steady cash-flowing asset.

-

Foreclosure and resale: If the borrower can’t or won’t pay, you can foreclose and sell the property.

-

Convert to rental: Some investors choose to keep the property and rent it, generating ongoing monthly income.

-

Partner with a rehabber: You can sell or partner with a rehab investor to fix and flip the home for profit.

Each scenario has different timelines, risks, and returns, but they all share one thing in common—you control the outcome.

Getting Involved

Mortgage note investing isn’t for everyone. It requires due diligence, patience, and the ability to analyze both the borrower’s situation and the underlying property. But for those willing to learn, it offers a unique combination of high potential returns and direct control over your investment—especially when held inside a self-directed IRA or Roth IRA.

At Vineyard Fund, we regularly review these mortgage assets—both performing and non-performing. While we can’t acquire them all, we often share opportunities with qualified investors who are ready to act quickly.

If you’re interested in learning more about buying notes for your IRA, or reviewing available note pools, reach out to us. We’ll walk you through the process and help you determine whether note investing is a fit for your portfolio.